Plugins

Q&A

Can Magento calculate shipping VAT correctly for the UK?

Of course - just use standard rate. Or zero rate if all your goods are zero-rated.

What if some products are zero-rated and others aren't?

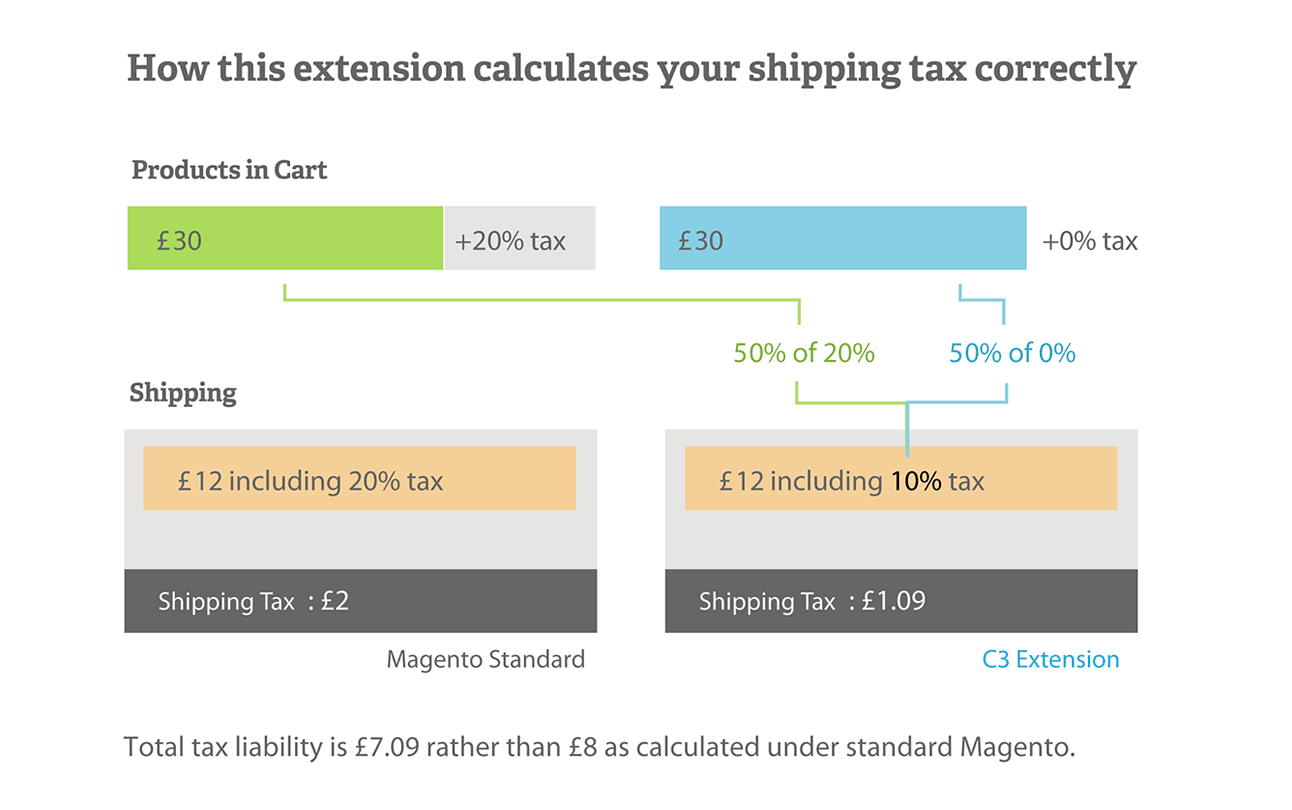

Ah, then sorry - Magento can't calculate your shipping VAT, because according to HMRC, the shipping VAT rate should be "the same rate as the goods being delivered or posted" (see this VAT guidance), so it should be pro rata'ed based on the goods sent. The good news is that this extension adjusts the tax rate for shipping to match the pro-rata rate of cart products

Features

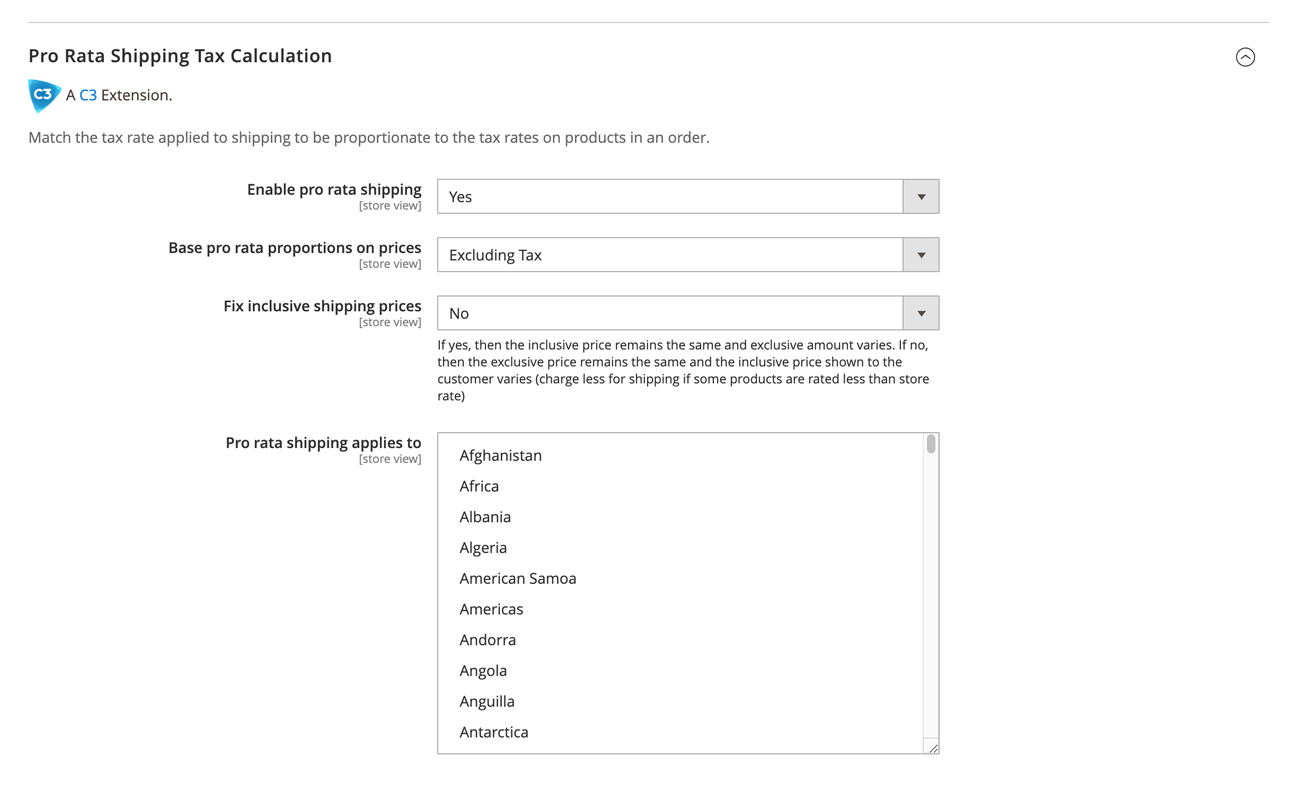

- Choose to base proportions on inclusive or exclusive prices.

- Choose which countries pro rata shipping VAT applies to.

- Correctly displays shipping VAT and total VAT in orders if summaries are enabled.

- Option to keep either the exclusive or inclusive shipping price fixed.

- Also works for taking admin orders.

- Enable/disable by website or store.

Version

1.0.7Compatible with

2.3.*, 2.4.0-2.4.7Requirements

Magento Open Source or Commerce 2.3.* or 2.4.*

Tax must be set up on your site and products in order to calculate shipping tax.

Compatibility & Quality

Use whatever carrier and shipping extension you like.

The pro rata shipping tax extension is developed using the magento 2 plug-in and event architecture to maximise compatibility with other extensions and magento itself. Therefore you can use a custom shipping module such as shipping rules or matrix rates.

Developed by Magento certified developers with a full set of unit and integration tests.