Blog

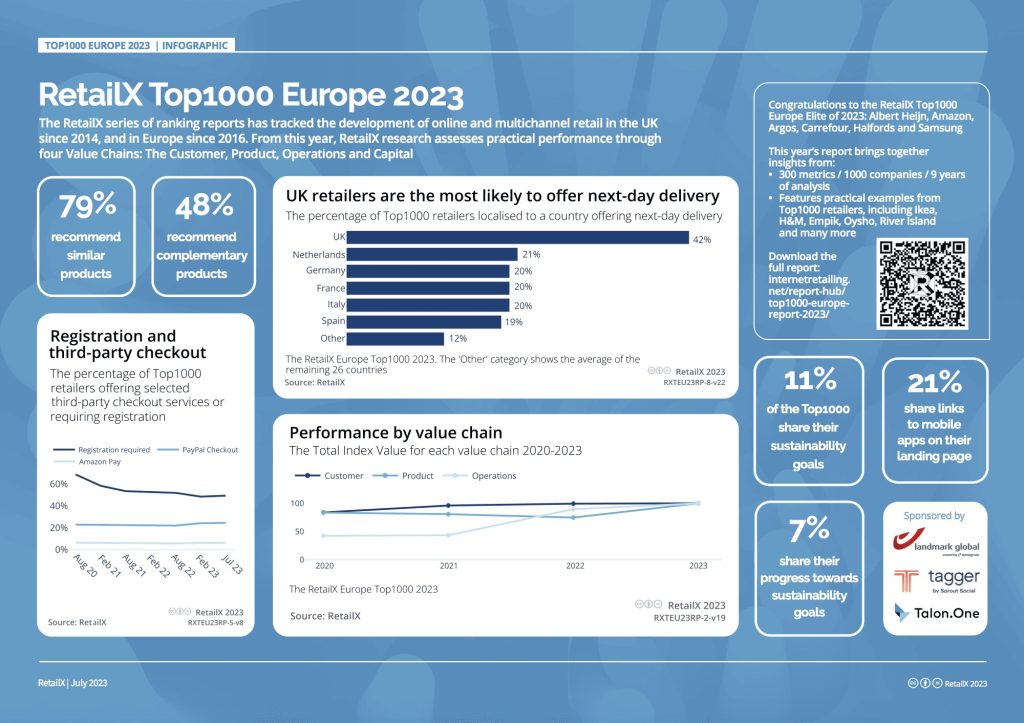

RetailX is a research and analytics organisation, specialising in the analysis and ranking of top multichannel retailers and brands. RetailX produces regular reports, often geographically based, containing detailed analysis of market performance, consumer trends, and top leading retailer performance – notably including the trends and approaches that these retailers employ.

In this post, as part of the C3 eCommerce TL;DR newsletter, I summarise the state of the European markets and retail spending, and highlight what I feel are the key takeaways from this year’s Top1000 Europe report. This is intended to be short-form, for those who don’t have the time to read the entire 55 page report. For reference, or indeed if you wish to learn more, you can head on over to the RetailX website to access the entire, comprehensive Top1000 Europe report, including all stats.

The State of Retail

Inflation rates have been incredibly high this year across most European markets, due in large part to the tail-end of the Covid pandemic, the war in Ukraine, and more recently the Israel-Gaza war. This has caused a rising cost of living in many areas, and has put considerable pressure on consumers’ purchasing power.

The RetailX report’s data covers a period up until June this year, and since then inflation has generally fallen across the board. According to this eurostat euroindicators report published a few weeks ago, the euro area annual inflation rate was 4.3% in September 2023, down from 5.2% in August. A year earlier, the rate was 9.9%. However, in regards to retail spending, this has seen also seen a decrease, with the volume of retail trade down in August 2023 by 2.1% in the euro area and by 2.0% in the EU compared with August 2022.

In the UK, according to the ONS we’ve seen the Consumer Prices Index (CPI) rise by 6.7% in the 12 months to September 2023, the same rate as in August, and down from a recent peak of 11.1% in October 2022. Retail spending has fallen by 1% in September 2023 compared to a year earlier.

So in summary, times are still tough for most retailers. Read on for an overview of consumer trends during this challenging period, and following that, what the top performing retailers are doing.

Current Consumer Trends

| Trend | Action(s) |

|---|---|

| Shoppers are avoiding premiums wherever possible. Retailers can increase the likelihood of customers purchasing, by offering cheaper, or free, shipping options. | Review your shipping options. Do you offer a cheaper option, compared to fast, premium delivery? Are you able to offer free shipping options? To protect your margins, you might consider offering free delivery only on baskets over a certain value. |

| Consumers are purchasing more directly from brands – either via their own websites or via marketplaces. | If you don’t currently sell via marketplaces, now would be a good time to consider this. Marketplaces are incredibly popular with consumers, and there are more options now than ever before. This can be a great way to increase customer reach. |

| Mobile app usage is in decline | Now may not be the best time to invest heavily in a mobile app. Instead consider investing further in your eCommerce website. As a general rule, the best starting point is reviewing your data, and making informed decisions on where to optimise, improve and evolve. |

| TikTok share in retail sales is growing rapidly | TikTok has a suite of eCommerce focused tools for retailers, including TikTokShop, with existing integrations for most of the major eComm platforms. Consider selling on this hugely popular platform to increase customer reach. |

| Use of loyalty schemes rising | Invest in your customer loyalty scheme to increase repeat sales and Customer Lifetime Value, as well as to gain valuable insight into your customers. Consumers are generally willing to trade their data in exchange for rewards. You can then use this data to further improve the shopping experience for your customers. Don’t have a loyalty scheme? Now’s a great time to consider introducing one. |

| Data is playing an ever more important role | Review your eCommerce business intelligence. Use the data you’re collecting to determine how your customers want to shop, rather than how you want them to shop. Optimise the experience based on custom behaviour and feedback, and watch sales rise. |

European Top 1000 retailer trends – consider doing these!

| Trend | Action | |

|---|---|---|

| Offering PayPal as a payment option | PayPal adoption continues to grow, globally. If you don’t already do so, add PayPal as a payment option to your site. Advertise that you support payment via PayPal, and consider utilising PayPal’s credit payment options, providing your customers with payment flexibility. |

| Showing supported payment options on landing pages | Advertise the payment options you support on your homepage and any other landing pages. This is shown to increase conversion. |

| Requiring customer registration | This may seem counterproductive, however with the increasing need to stay close to customer data, and to be able to personalise the shopping experience, requiring customers to register for an account can be advantageous in this regard. |

| Saving of customers’ baskets | Look at your basket retention – you should be allowing your customers’ baskets to persist indefinitely, or as long as is practically possible. If a guest customer returns to your website, having added products to their basket 3 months previously, they may well be frustrated if their basket is now empty. You’re harming conversions if baskets are cleared prematurely. |

| Adding stock visibility | Confirming that a product is in stock and available to purchase is a sure way to increase conversion rate. If a product is out of stock, allow the customer to be notified when it’s back in stock – not only are you prompting the customer to return to the site, but also capturing interest in currently out-of-stock products – a key piece of data to add to your arsenal. |

| Allowing product searching by price and brand | Consider adding filtered (aka faceted/layered) navigation to your catalogue and search pages to allow easy refining of product list views, and enabling filtering by price, and brand – if applicable. Customers being able to find relevant products faster aids in conversion. |

| Providing multiple, zoomable, product images | Allowing customers to get a good feel for your products by offering multiple product shots, possibly from different angles, of different features, or in-situ lifestyle type shots increases customer engagement with your product range. Where applicable, images should be zoomable to allow the customer to more easily check out the details of the product. |

| Providing product videos | In the same vein as offering high-quality, zoomable images, providing videos is another great way of increasing customer engagement. |

| Tagging best-selling products | Consider adding a ribbon or badge to best-sellers, to highlight popular products to your customers. Popular products inherently have a wide appeal, and therefore high relevancy. |

| Showing fulfilment options on product pages | Showing the available delivery methods and speeds on the product page can aid in conversion. You might consider highlighting the cheapest, and/or fastest delivery method here, à la Amazon. |

I hope you find the above useful – even if this validates what you are currently doing. There is much more detail in the report, and if you have the time, I recommend checking it out. And of course, if you would like to chat with us at C3 about optimising your eCommerce experience further, and really making it sing, we would be delighted to hear from you.